Articles

Once you’ve inserted, add a free family savings ($5 lowest put deposit 1$ play with 20$ casino ). Register and log into digital financial and set upwards a being qualified payroll direct deposit(s) you to overall at least $500 for each and every calendar month. Canadian people may take advantage of now offers giving her or him around C$31 within the incentive bucks with $5 minimal put gambling enterprises Canada bonus. That is a fantastic choice if you are to the classic titles otherwise bingo and you may arcade game. Loads of common advice about playing in the web based casinos try geared toward larger places, particularly if you do not reload your bank account frequently.

Nonresident Companion Treated since the a resident – deposit 1$ play with 20$ casino

Regulators earliest pay aside from income tax-exempt pay money for services did away from Us. Christina Brooks, a resident of the Netherlands, worked 240 days to possess a great You.S. team within the tax 12 months. Christina did features in the us for 60 days and you can performed services from the Netherlands to have 180 weeks. By using the time reason for deciding the cause away from payment, $20,one hundred thousand ($80,100 × 60/240) is Christina’s U.S. resource earnings. Nonresident aliens is taxed merely to their earnings of source within this the us as well as on particular money associated with the fresh carry out from a swap or team in the us (find chapter 4).

Does certificate out of put membership interest have to be placed into Connecticut return?

- To learn more, come across Nonresident Partner Treated because the a resident and you may Opting for Citizen Alien Status, later on.

- One to on the income and write-offs from the possessions linked to the brand new IRC Part 1361(d) election and something on the money and you may deductions regarding the most other assets.

- Tax withheld to your dispositions of You.S. real estate interests.

- Unless you provides overseas origin earnings effectively related to a great You.S. trading or business, you simply can’t claim loans up against their U.S. tax to have taxes paid back otherwise accrued in order to a different nation otherwise U.S. territory.

- After you’ve calculated the alien status, the main cause of the money, and if and exactly how one to income is actually taxed in the Joined Claims, the next action is to profile your income tax.

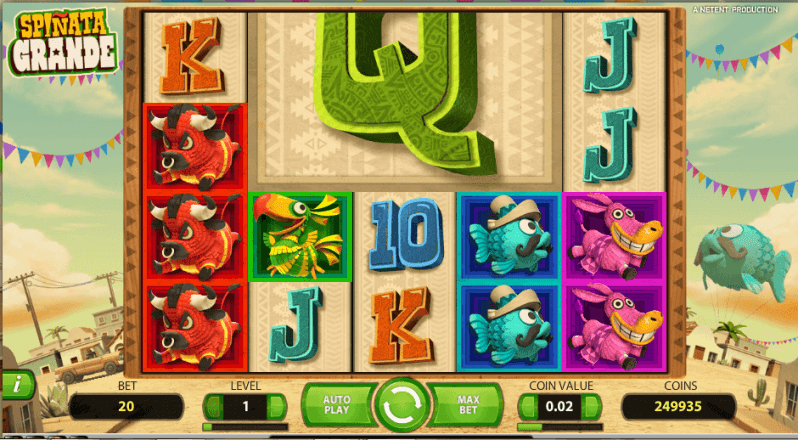

We inquire all our subscribers to check the local gambling regulations to make certain gambling is legal on your own legislation. We simply cannot become held responsible for the hobby away from third-party other sites, and don’t remind betting where it is illegal. You’ll be able to locate to one hundred 100 percent free revolves provide and take, depending on the $5 minimal deposit gambling enterprise. Yet not, the level of free spins cannot score much higher as the they constantly depends on the fresh transferred count.

Getting Ca Income tax Guidance

You need to submit Form W-8BEN or Function 8233 and give it to your withholding representative otherwise payer through to the earnings is actually repaid otherwise paid for your requirements. When you’re an employee and you also discover earnings at the mercy of graduated withholding, you’re expected to fill in a questionnaire W-4. These are characteristics you are required to manage while the a member of staff so when a condition of getting the brand new grant otherwise fellowship (or university fees avoidance). When you’re hitched and you can your mate try expected to file, you must for each document a different get back. Because the a twin-position alien, you might fundamentally allege tax loans using the same regulations one to apply at citizen aliens. This type of constraints is actually talked about here, as well as a quick explanation out of loans often stated from the people.

An entire and you can precise disclosure of an income tax condition to your appropriate season’s Plan UTP (Function 1120), Uncertain Taxation Position Report, would be treated because if this provider recorded an application 8275 or Function 8275-Roentgen about your taxation status. The newest submitting from a type 8275 otherwise Function 8275-Roentgen, although not, won’t be handled since if this business submitted a timetable UTP (Mode 1120). You would not have to pay the fresh punishment if you possibly could show that you’d reasonable to possess not paying your income tax punctually. You might have to file Setting 8938 so you can statement the newest ownership from a specified overseas monetary asset(s) when you’re one of many pursuing the people. Civil and you will criminal charges are provided to possess failing continually to file a good report, processing research which includes matter omissions otherwise misstatements, or submitting an incorrect or fake report. As well as, the complete amount of the newest money otherwise financial tool is generally at the mercy of seizure and you will forfeiture.

Columbia Financial Examining — as much as $800

Public defense and you will Medicare fees will be withheld from your spend for these services when you’re experienced a citizen alien, as the talked about in the part step one, whether or not your nonimmigrant classification (“F,” “J,” “M,” or “Q”) continues to be the same. The new discretionary dos-few days extra expansion isn’t offered to taxpayers who’ve an acknowledged extension of energy in order to document to the Function 2350 (to own U.S. residents and you may citizen aliens abroad whom expect to be eligible for unique income tax therapy). For individuals who expatriated or ended the residence in the 2024, you’re needed to file a keen expatriation report (Form 8854) along with your tax come back.

Free Checking

What exactly is great about these choices is they do not have lowest import demands, to help you very wade only you would like if you are to play during the an on-line gambling establishment no minimal put needs. Our values regarding the $5 gambling establishment incentives is you should try to get taken care of doing things you used to be probably going to be carrying out anyhow. In this way, delivering taken care of playing your favorite online game is a good idea even though you are making a minimal $5 minute put. Although not, since there are many different lowest deposit gambling enterprises having $5 advertisements and you may incentives, we have to take a closer look in the what is actually available.